Fact sheets derivative funds

In February, the Emerging Market Index rose 5.3%, mainly due to China (+9.7%), which has an index weighting of 26%. Despite disappointing macro data from China, the market was bought higher now that v... Read more

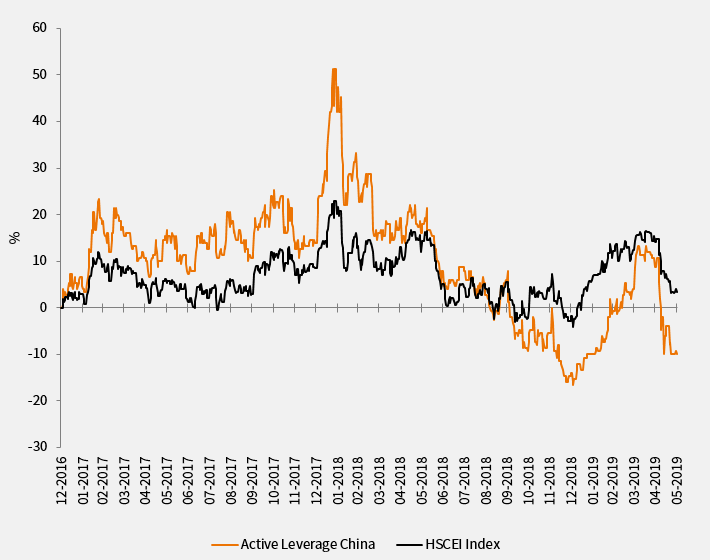

Intereffekt Active Leverage China is an active mutual fund, which uses a trading model. The fund invests in Chinese index products and derivatives. Based on the trading model the short term trend of the underlying assets will be determined.

When the signal is positive the fund is aiming for a leverage of 2 to 3 times the return of the underlying assets. When the signal is negative the leverage will be decreased to one. The fund is aiming for an outperformance when the trend is positive. When the trend is negative the fund aims for an average return compared to the index. In a sideways market there is a possibility that the trading model experiences an underperformance. The risk profile is high. The fund is aiming for capital growth. The fund will not pay any dividends. The manager will not use a benchmark as a gauge for the purposes of determining the investment policy or comparing the results.

The fund is a subsidiary of Intereffekt Investment Funds N.V. (IIF), established with a so-called umbrella structure.

This fund is designed for investors who are familiar with the risks involved in the use of derivatives. Prospective investors should ask their investment consultant to determine whether or not this fund is suitable for them and ask for advice about the term for which the shares should be kept. The leverage is reweighted periodically and the fund may therefore not be suitable for the long term.

No rights may be derived from this publication. You are referred to the prospectus and Key Investor Information Document for the fund's terms and conditions. These documents may be obtained from the website or the address mentioned below. The manager of IIF has obtained a licence for this fund from the Netherlands Authority for the Financial Markets in accordance with the provisions of the Financial Supervision.